By Tom White – VA Right - Cross-Posted at Ask Marion:Two recent court cases came to two different conclusions in the battle against Obamacare. The question was concerning the language of the bill when it comes to credits in Health Care Exchanges set up by the Federal Government when states decide not to set up State Health Care Exchanges.

The language is pretty clear in the fact that it does create credits for Exchanges set up by the states. These credits are substantial and are the only part of the entire Affordable Care Act that actually addresses affordability. Sadly, this is done by redistributing the wealth. By taxing the productive earners in order to subsidize non-productive earners.

Monthly premiums for silver plans – the standard insurance policy sold on the exchanges – cost an average of $345 a month this year for people who did not qualify for subsidies, a new analysis from the administration shows. – See more at: http://www.thefiscaltimes.com/Articles/2014/06/18/Average-Obamacare-Subsidy-3312-Paid-Date-47-Billion#sthash.OQTugto5.dpuf

According to The Fiscal Times:

Monthly premiums for silver plans – the standard insurance policy sold on the exchanges – cost an average of $345 a month this year for people who did not qualify for subsidies, a new analysis from the administration shows.

However, for the overwhelming majority of Obamacare enrollees (87 percent) who did qualify for financial assistance, the average monthly premium on the silver plan costs about $69. That’s an average tax credit of about $276 a month, or $3,312 a year. The administration’s report broke down the average monthly premium for each of the four plans offered on the federal marketplace – before and after tax credits. It also detailed the percentage of enrollees selecting each plan, with or without tax credits. Data was not available for the state exchanges, which make up about one third of the total 8 million enrollees.

On average, monthly premiums after subsidies run about $69.00. But without the subsidy, $345.00. And 87% of enrollees qualify for these huge subsidies.

So with all the mandates for coverage, mandates on what must be covered and what can be charged, it is the subsidies and the subsidies alone that make the product affordable. Without them, the cost of Health Insurance rises considerably due to mandatory expanded coverages.

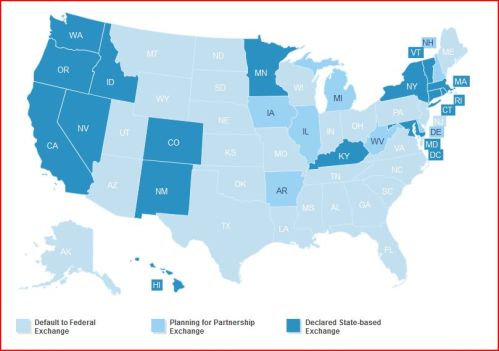

The Affordable Care Act depends on states setting up Exchanges as called for in the law. However, when much of the law was in the process of being written, it was done in secret. No one knew exactly what was going into the mix and the authors were as yet unaware of the massive resistance the bill was about to encounter. But they anticipated at least some token resistance from the rascally Republican controlled states. And this expected resistance was addressed in the bill with various sneaky political weapons and landmines designed to nudge resistive states into setting up the exchanges.

One political weapon the Democrats love to use is abortion. Republicans are outraged when tax dollars are confiscated to pay for a procedure they consider infanticide. So one of the booby traps the architects of Obamacare used was abortion. This would be the first of several “lesser of two evils” options resistive Republican states would face in deciding to implement Obamacare. You may recall the Stupak Amendment that extended the Hyde Amendment wording that prevents the Federal Government from paying for abortions. There was a big argument in House over abortion and several pro life Democrats insisted that the ACA not pay for abortions as a condition of casting their vote for the bill. However, that was the House Bill which was scrapped after Scott Brown’s victory effectively cut off the Democrat’s super majority in the Senate.

The Conservative Intelligence Briefing put it this way:

Recall that after the special election of Sen. Scott Brown, R-Mass., in January 2010, Democrats were suddenly deprived of the flexibility they had expected to have in drafting the law’s provisions. They had expected a House-Senate conference committee in which they could iron out the kinks in the law and then pass it again through both the House and Senate. But suddenly, after Brown won, they realized they would never be able to pass any version of Obamacare through the Senate again. They no longer had the 60 votes they needed.

So the Democrats did the only thing they could: They took the version of the law they had already passed through the Senate on Christmas Eve 2009, and rammed it back through the House, warts and all. There was no second chance to consider this issue or any others in detail. In any event, most members had only a vague idea of what the bill did anyway.

- See more at: http://www.conservativeintel.com/the-briefing-vol-ii-issue-25/?utm_source=Intel&utm_medium=email&utm_campaign=House#sthash.tC38djHj.dpuf

Recall that after the special election of Sen. Scott Brown, R-Mass., in January 2010, Democrats were suddenly deprived of the flexibility they had expected to have in drafting the law’s provisions. They had expected a House-Senate conference committee in which they could iron out the kinks in the law and then pass it again through both the House and Senate. But suddenly, after Brown won, they realized they would never be able to pass any version of Obamacare through the Senate again. They no longer had the 60 votes they needed.

So the Democrats did the only thing they could: They took the version of the law they had already passed through the Senate on Christmas Eve 2009, and rammed it back through the House, warts and all. There was no second chance to consider this issue or any others in detail. In any event, most members had only a vague idea of what the bill did anyway.

- See more at: http://www.conservativeintel.com/the-briefing-vol-ii-issue-25/?utm_source=Intel&utm_medium=email&utm_campaign=House#sthash.tC38djHj.dpuf

Recall that after the special election of Sen. Scott Brown, R-Mass., in January 2010, Democrats were suddenly deprived of the flexibility they had expected to have in drafting the law’s provisions. They had expected a House-Senate conference committee in which they could iron out the kinks in the law and then pass it again through both the House and Senate. But suddenly, after Brown won, they realized they would never be able to pass any version of Obamacare through the Senate again. They no longer had the 60 votes they needed.

So the Democrats did the only thing they could: They took the version of the law they had already passed through the Senate on Christmas Eve 2009, and rammed it back through the House, warts and all. There was no second chance to consider this issue or any others in detail. In any event, most members had only a vague idea of what the bill did anyway.

So the truth is, there is no language in the Senate Bill itself that prevents the Federal Government from paying for abortions. And in order to get the pro life Democrats to vote for the Senate version of Obamacare, Obama issues an executive order #13535 that pretends to forbid Federal payment of abortion. None of the pro life groups were fooled, nor were the voters in Stupak’s District in Michigan. Stupak “retired” and the voters put a Republican in the seat.

But according to Wiki, there are incentives to entice states into setting up these Exchanges:

Under the law, setting up an exchange gives a state partial discretion on standards and prices of insurance, aside from those specifics set-out in the ACA. For example, those administering the exchange will be able to determine which plans are sold on or excluded from the exchanges, and adjust (through limits on and negotiations with private insurers) the prices on offer. They will also be able to impose higher or state-specific coverage requirements—including whether plans offered in the state are prohibited from covering abortion (making the procedure an out-of-pocket expense) or mandated to cover abortions that a physician determines is medically necessary; in either case, federal subsidies are prohibited from being used to fund the procedure. If a state does not set up an exchange itself, they lose that discretion, and the responsibility to set up exchanges for such states defaults to the federal government, whereby the Department of Health and Human Services assumes the authority and legal obligation to operate all functions in these federally facilitated exchanges.

And if having more control and discretion on the policies offered in each state isn’t enough to convince states to implement Obamacare, the Democrats added a big hammer. The Federal Government will come in and run things, leaving the states no say in how health care policies are sold in the state. Take that, you Republicans.

This Youtube video is a recording of the chief architect of the Senate Obamacare bill. The guy who put the political plums and hemlock in the bill, Jonathan Gruber. It is clear from listening to him speak that the intent was to use the lack of subsidies in the Federally run Exchanges as a mechanism to force states into compliance.

Video: Jonathan Gruber Once Again Says Subsidies Are Tied to State-Based Exchanges

But Gruber said that this was a mistake. A speak-o (as opposed to a typo). The intent was always to have the Federally run Exchanges give out the subsidies!

There is a video here that is nearly an hour long that has been making the rounds on the internet. I edited the same video down to about 5 minutes with the important parts being about the first 2 minutes. The rest of this is some pretty revealing comments Gruber made on the longer version.

Video: Jon Gruber Condense Version

So it is abundantly clear that the intent was to use the lack of subsidies in the Federally run exchanges to pressure states into compliance.

So in the two recent court decisions in direct opposition to one another as FoxNews explains:

WASHINGTON – Two federal appeals court rulings put the issue of ObamaCare subsidies in limbo Tuesday, with one court invalidating some of them and the other upholding all of them.

The first decision came Tuesday morning from a three-judge panel of the U.S. Court of Appeals for the District of Columbia. The panel, in a major blow to the law, ruled 2-1 that the IRS went too far in extending subsidies to those who buy insurance through the federally run exchange, known as HealthCare.gov.

A separate federal appeals court — the Fourth Circuit Court of Appeals — hours later issued its own ruling on a similar case that upheld the subsidies in their entirety.

The conflicting rulings would typically fast-track the matter to the Supreme Court. However, it is likely that the administration will ask the D.C. appeals court to first convene all 11 judges to re-hear that case.

In both instances the government argued that it is obvious that the intent was to include federal subsidies in the Federally run Exchanges if the states refused to do so. But listening to the guy that wrote the bill, the exact opposite is the case. The subsidies were left out on Federally run Exchanges to use as a weapon to either force Republican governors to implement a state exchange or face the voters to explain why they are paying more for health insurance and get no subsidies. The hope of this Democratic bill was to force Republicans to do something they did not want to do.

Now one of the arguments I have not heard made is that on the issue of abortion on Federally run Exchanges. One of the incentives for the Liberal states to jump in and implement exchanges is the ability to mandate expanded coverages such as 100% payment for abortions. And if we follow the same logic the government argued in the two conflicting ruling cases, that the Federal Government steps in and is essentially considered the state for all intents and purposes – something I find preposterous – then what is to stop the Federal government who suddenly finds itself a surrogate for the state from mandating abortion coverage (from Wiki linked above):

Under the law, setting up an exchange gives a state partial discretion on standards and prices of insurance, aside from those specifics set-out in the ACA. For example, those administering the exchange will be able to determine which plans are sold on or excluded from the exchanges, and adjust (through limits on and negotiations with private insurers) the prices on offer. They will also be able to impose higher or state-specific coverage requirements—including whether plans offered in the state are prohibited from covering abortion (making the procedure an out-of-pocket expense) or mandated to cover abortions that a physician determines is medically necessary;

So if the federal government can come in and replace the state in every way, then the same argued consideration as far as subsidies would extend to the other areas of “partial discretion” of the states. And the law could then go around the Obama executive order prohibiting federal funds from paying for abortion.

This must go to the Supreme Court and the 36 states without state run subsidies must stop receiving federal subsidies.

And as Gruber says in the long version of the video, repeal is unlikely to get rid of Obamacare. But neglect in the form of non compliance will cause it to implode in on itself. He uses a 3 legged as an example. The legs are eliminate pre existing conditions, insurance mandates and subsidies. Take away one of the legs and the law collapses. No one is fighting the pre existing condition elimination and the horrific Supreme Court ruling that held the mandates were a tax (and thus constitutional) is gone as a possible tool to kill the law. The last remaining leg is the subsidies. Without them, the law cannot survive. And since 36 states refused to set up exchanges, this is a huge threat to Obamacare’s survival.

With more and more information being unearthed every day about this bill, this is an important battle in the war on healthcare being prosecuted by the Obama Administration.

Update:

My theory is that if the Court rules that Federal Exchanges are essentially State Exchanges for the purpose of the subsidies, then the Feds are, essentially, the state. States are free to mandate abortion coverage, the Feds are not by Executive order. So if the Federal Government becomes a state for subsidies, then the Feds can mandate abortion coverage and also get around the Exec. Order. Tom White